Things are going down…

Like me on the Oxford canal, heading in a southward direction.

Not only that, but in many other areas of life in and across the world.

My life as a trader

You may or may not know that I spend a lot of my spare time looking at markets, reading economic journals and placing occasional trades on conventional and crypto assets. A day trader, you might say.

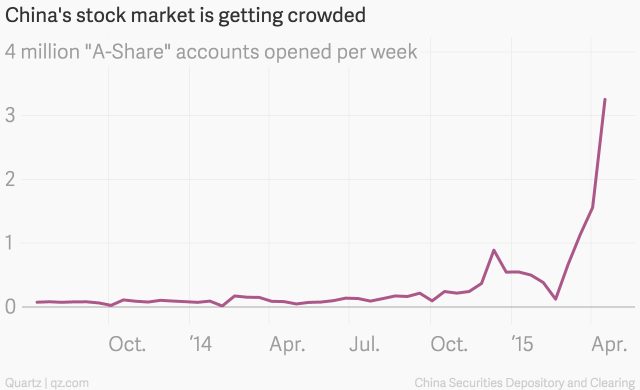

Taking in some of the moves in those markets, and predictions for the future leads me conclude that things are definitely moving, in a downward direction.🔻

I believe that life in the UK and the economy under the current prime minister is not viable, and given time will implode. Even in the last few days I read posts about Crispen Odey, one of Kwasi Kwarteng’s close friends, making 145% on UK bond crash, (below).

Relying on ‘trickle down economics‘ at a time of financial tsunami? It’s supplying those at the top with more incentive. Doesn’t make sense unless you want the top 5% to benefit significantly more at a time when they really don’t need any more.

Even if you don’t understand this graph, (which I’m not going to explain), you can see the movements are pretty drastic.

…